- The EV Universe

- Posts

- EVU Report: 🤦♂️ "I told you EVs don't work" — ⚡️ Tesla now sells Superchargers — 📉 Volta Trucks bankrupt

EVU Report: 🤦♂️ "I told you EVs don't work" — ⚡️ Tesla now sells Superchargers — 📉 Volta Trucks bankrupt

Hey, Jaan here.

I’m super happy to say that since our last newsletter, we have hit not just the 4,500 subscriber milestone, but zoomed right past to over 4,700 of you lovely folks already. 👋 to all old and new EV geeks!

Oh boy, do I have electrifying news to share with you this week. I wrote 4,900 words for you. And another 2,500 on the Pro Reports. Oh boy.

You’ll love it though! ⚡️

Words: 4,913 | Time to read: who knows? | Feeling: everyone else zigs, we zag.

As usual — jump to our online version of this right from the start for the full experience.

I’m always happy when I’m able to partner up with folks who are right here in the EV industry with us. This is the only way for the “sponsored” section in this newsletter to be a win for the EV startup featured, win for the EV Universe as a business, and win for you, if the product is right. This one is for all of our European folks:

Introducing the EVDC Chargemap: Power Your EV with Convenience!

We're thrilled to unveil the latest addition to the world of electric vehicle charging - the EVDC Chargemap. With over 300,000 charging points at your fingertips, you can now fuel up your electric vehicle effortlessly and efficiently.

What sets EVDC Chargemap apart? We've eliminated the need for cumbersome member cards and extensive KYC procedures. Charging your EV has never been more straightforward. Just plug in, power up, and go! Say goodbye to the hassle and hello to a more convenient, eco-friendly journey.

Start exploring the world of EVDC Chargemap today:

If you are in the US and your friends and colleagues are citing the latest headlines to hit you with the “I told you EVs don’t work”, I’m here for you.

I’m here to assure you that you can just laugh it off and know that this is but a temporary relapse, which further determines the winners and losers of the new auto industry.

If I had not been studying the EV industry for the past three years, I’d be in the same boat, too. I mean, hard not to be if you see headlines like:

“Toyota Chairman Says People Are Finally Seeing the Reality About EVs” — WSJ

“Auto execs are coming clean: EVs aren't working” — Business Insider

“‘The early adopters have adopted’: US carmakers slow their EV growth plans” — Financial Times

Sounds pretty bad, right?

I see this moment right here will be a massive opportunity for some EV makers to grab a bigger pie of the future, while costing some ICE makers their (perhaps the last) chance to stay relevant in the near future. Or the last chance to stay in business overall.

Before we go further, I’ll go ahead and state this part: yes, BEV sales numbers, or rather the growth of these sales, can go down in the near future for short periods of time. Especially for the automakers that haven’t figured out how to make an actually competitive EV. This, however does not spell the doom on EVs.

But, let’s look at the news that are behind the recent sentiment.

GENERAL MOTORS SLOWS DOWN ON EVS

General Motors abandons its interim goals of building 400,000 EVs in North America by mid-2024. And the goal of building 100k EVs in the second half of 2023.

Now, in the Q3 letter to shareholders (link), the company rolled back these goals, while saying they still want to focus on “producing one million electric vehicles by the end of 2025 while meeting our margin targets.”

The CEO, Mary Barra, said the company’s future EV strategy is to match production to demand to avoid deep discounting.

Now, we could say interim goals don’t matter here, right?

Well, not exactly true. It all comes with collateral damage.

GM will also:

abandon an earlier plan to spend $5B on several new entry-level EVs;

postpone retooling the Orion plant for electric pickups in Michigan to “save” another $1.5B next year; and

switch the redesigned Chevy Bolt to LFP batteries to save on costs.

This means that its upcoming EVs like Chevy Equinox EV, Silverado EV RST, GMC Sierra EV and others are delayed, although Barra says they’ll be delayed by “only a few months”. Doubtful.

Yes, GM can blame the ongoing UAW strikes so far for needing to cut back on plans. All this, of course, also inspired this meme by yours truly.

GM ditches its goal of building 400,000 EVs by mid-2024

— Jaan of the EV Universe ⚡ (@TheEVuniverse)

1:31 PM • Oct 25, 2023

But I’m here to tell you (= wildly speculate) that this is not the whole picture. I had assumed General Motors to walk back on its lofty EV goals for a while (you’ve seen my pessimistic tone previously) and I could, sadly, bet that the 1-million EV goal by end of 2025 will not happen either.

Going on a bit of a rant here, but I believe this exact moment when things are a bit rougher (interest rates etc), will be the moment we can look back later on and say that it determined the outcome of the winners and losers in the auto industry, around years like 2030 and 2035.

Legacy automakers that rolled out the EV investment plans within our little hype’ish cycle for EVs we had here that are now walking back on their investments will lose out, significantly. Meanwhile the legacy auto retreating will be another massive advantage to the established and semi-established EV makers. It's boosting the first-mover advantage even more really. It will be the shot for upcoming EV startups that I didn’t even think they’ll get.

The legacy that slowed down will be dragged back… if alive.

Did all this cost General Motors its new CTO?

General Motors’ new CTO (and the VP of R&D and President of GM’s venture arm), Gil Golan, resigned after just a month on the job. For a profile by The Electric, he described “a plan to aggressively expand the company’s work in batteries, create a “dream team” of battery scientists, and manufacture batteries from the ground up” (link). Gil worked on the EV1 as a young engineer once, by the way. What will losing someone like Gil mean for GM’s all-electric future?

The legacy auto seems to have one of its first "I told you it doesn't work" moment with EVs. Some plans get scrapped. Some ICE plans reignited. Oh boy, will they have a hard realization when they figure out they missed one of the last chances to be prepared for the EV future. (tweet)

Not just General Motors

Honda cancels the General Motors ←→ Honda EV project for a jointly produced <$30k lower-cost model that would’ve rolled out in North America in 2027. (link).

“When we studied the business feasibility — for example marketability, or cost, or product attractiveness — we did not see great potential there. GM and Honda will search for a solution separately. This project itself has been canceled.”

What a great headline everywhere, also a testament for EVs don’t work, right? Not quite the whole story. The Honda CEO also admitted that they are just late in the game (video):

“In China, EVs and NEVs are the fast-growing segments. With us being late to the EV game and fierce price-cutting competition due to an already crowded market space, we are facing a challenging situation. By offering a wider product line-up we hope to improve our EV business, although it will take some time to get there.”

Meanwhile, the CFO of LG Energy Solutions, which is also the partner for General Motors with the Ultium plant, warns that “„EV demand next year could be lower than expectations.“

Ford is also slowing down its EV efforts by pushing out some of the $12B planned investment “until the time we need to put that capacity in place”. It’ll also cut some production of the Mustang Mach-E and delay construction on one of two joint-venture battery plants planned in Kentucky.

“The narrative has taken over that EVs aren’t growing.

They’re growing… It’s just growing at a slower pace than the industry, and quite frankly — we — expected.”

Will we see Ford walking back on its target of 600k EVs (I think it was run rate?) in 2024? Looks like it.

Mercedes’ CFO, Harald Wilhelm, said in the company’s Q3 earnings call that

“With some traditional players selling BEV vehicles below the level of ICE ... this is a pretty brutal space. I can hardly imagine the current status quo is fully sustainable for everybody."

Umm… wasn’t selling BEVs below the ICE prices the goal all along?!

Mercedes may instead “look more towards a second wave, after the first wave of early adopters grabbed what they can get in the market with heavy discounting.” (link)

How about the rest?

We studied where Tesla stands in our Teslaverse newsletter last week (here), and we know where the EV-only makers sit. The borderline-depressed tone of Musk on the call makes Tesla a great scapegoat for other OEM execs to say “EVs weren’t meant to work anyway”.

Are all of the legacy automakers slowing down like this? Not quite.

„Hyundai will not delay the introduction of new electric cars, unlike other manufacturers.

We do not plan to dramatically reduce EV production or our line-up due to likely near-term hurdles as we believe EV sales will grow longer term.“

Alongside this, it seems Hyundai really is on the right track as they just dropped Ioniq 6 prices in US by $4,100 (now starts at $38,615) citing “because of production efficiencies and scale”. (link) Which, of course, could just also be them responding to Tesla price cuts. 🤷♂️

Whatever the works, it seems Hyundai will be one of the legacy companies that will come out of this EV transition as a winner. Actually, whichever automaker can use this moment for doubling down on EVs, will win.

So nobody is buying EVs, right?

About that.

EV sales made another record in the US in Q3, with 313,086 EVs per the Kelley Blue Book estimate (link). This put EVs at a 7.9% market share (6.1% a year ago).

The pace of growth is slowing, as year-over-year the sales grew ~75% in Q3 2022 vs Q3 2021, but “only” 49.8% in Q3 2023 vs Q3 2022.

Year-to-date EV sales through September reached just over 873,000, putting the market firmly on track to surpass 1 million for the first time ever. Three years ago, in 2030, we ended at 250k. EV sales have now increased for 13 straight quarters.

The average EV bought is getting cheaper too, thanks to the Tesla-started slashing of prices across the industry. The average price paid for an EV in September was $50,683, down from more than $65,000 one year ago. Still “up there”, granted, but we’ve not yet the floor that EVs can achieve yet, have we.

Here’s a view of the BEV mix of the legacy brands sales in Q3 in the US. Perhaps it’s also a good time to note where all those EV doomsayers are located in the chart.

For a better way I should do a chart that has these coupled with sales volume, could give us an even better view overall.

Here are the EV sales per brand and model in the US in Q3 and YTD (link).

I put together the top five across the automotive groups:

Tesla 156,621 (up 19.5% year over year)

Ford 20,962 (up 14.8%)

VW Group 20,295

General Motors 20,092 (of which 15,835 were Chevy Bolts)

Hyundai 19,630 (up 237.1%)

Per EV models, it looks like this:

Tesla Model Y 95,539

Tesla Model 3 53,251

Chevy Bolt 15,835

Ford Mustang Mach-E 14,842

Hyundai Ioniq 5 11,665

Jaan’s rant

We knew that EV transition won’t be easy. That doesn’t mean it isn’t the right way to go.

We’re seeing the fossil-minded boasting the "I told you EV's won't work", and all of them turning to ICE might even be praised for it for a moment.

That moment will fade soon though. There might be some, but probably not too many of these moments coming up before reaching our all-electric future.

The companies that relapse back into ICE, will see losses because of this. Not right now though — they’ll improve their business in the short term because they lower the EV investments. But they are giving up the future with it:

not realizing the potential of going head-on at EVs will lead to loss in longer term. This can only seen as hindsight down the road. The “when demand gets high enough, we will do those moves” doesn’t work.

The actually competitive EVs will keep doing magnificently well, even if the economic situation all around us draws them down here and there.

I’ll put together some numbers for you in the newsletters soon to show you the real situation of the BEV market (vs ICE). I’d love to fast forward to 2030’ish to see if my rants above check out, but in the meantime… let’s carry on.

Ford and UAW agree on a contract after over 41 days (link). Ford workers’ hourly rates will grow by +25% by the end of this 4-year contract. The lowest wage now has a floor of $28 per hour. Also, Ford has agreed with the COLA, which means inflation adjustments for the wages. What’s yet to be seen is if this deal is just for the auto plants or also the battery cell plants?

Stellantis and UAW also agreed on a tentative contract, on Day 44 of the strike, seems as on similar terms as with Ford. (link) Some details on the deal from UAW: (link).

Jaan at the end of 2022: “I'm surprised there aren't too many of the we'll only sell BEVs in Norway from 2023 announcements yet.” Then, Hyundai announced in January 2023 that they’ll go BEV only. It took a bit of time, but now we’ve got the next one:

Volkswagen will stop selling combustion vehicles in Norway from 2024, after 75 years in the country. (link in 🇳🇴) I continue to expect these announcements to start to pop up market-per-market in the next few years, way before the regular ICE-quit targets of 2030/35.

Australia: Uber 🤝 EVDirect, the BYD importer in Australia, to make 10,000 BYD Atto 3s available to Uber drivers, with financing options through EVFlex. (link) Uber also launched Comfort Electric for business clients in Australia and will offer incentives for 500 Victorian drivers to transition to EVs. I continue to l o v e the impact that comes with replacing fleets en masse like this.

Fun fact from above: In Q3 of 2023, more than 1.2M Uber rides were taken in an EV. 2,400 EVs have operated on its platform in Q3. Up from <100 in early 2021.

Remember the electric Paulaner beer truck from Volta rolling into Oktoberfest I featured in the last newsletter? Well, in a surprise to me, it might’ve been the last of those you’ll see.

Volta Trucks files for bankruptcy.

Volta was about to bring the world’s first purpose-built 16t all-electric truck to the market, and had pilots running in five European countries. A source told Reuters they were “30 days out from production”.

It looks like some of its problems (surely not all however) comes in as Volta being collateral damage to the Proterra bankruptcy (link referring to my copy of press release, as the site is now blocked with a generic message):

“Like all scale-ups in the EV manufacturing sector, Volta Trucks has faced challenges along the way. The recent news that our battery supplier (Proterra) has filed for Chapter 11 Bankruptcy, has had a significant impact on our manufacturing plans, reducing the volume of vehicles that we had forecast to produce. The uncertainty with our battery supplier also negatively affected our ability to raise sufficient capital in an already challenging capital-raising environment for EV players.”

Volta Trucks is looking for a buyer to take the company out of bankruptcy and help it realize series production. They’ve reportedly received´enquiries from 10 to 20 potential investors so far. (link)

I am rather sad to see this one go under. We needed these trucks on the roads.

Quick bites

Stellantis will acquire a 21% stake in Leapmotor for €1.5B (~$1.58B) and forms a 51-49 joint venture with it for international markets, including Europe. (link) Here’s a background piece to understand who Leapmotor is (link). We’ll see more of the Euro<>China EV mix incoming, that I’m sure of.

If you’re a Tesla shareholder, you can sign up for a Cybertruck delivery event ticket lottery through its investor portal. (link) The event takes place in Giga Texas on the 30th of November.

Formula E announced its 10th season calendar, China (Shanghai) and India (Hyderabad) join the locations. (link) The 1st race is on my birthday in Mexico City. What do you mean you don’t know when that is?

“It's like driving the Empire State Building, it's amazing, it moves just like a car.”

— Jay Leno, driving the Tesla Semi

I showed you this video about the Tesla Semi with Jay Leno, Dan Priestley and Franz von Holzhausen last time (43min video) and promised a recap of the learnings for you. Here are my highlights:

Jay Leno also said he didn’t notice the difference in driving with or without the load.

The idea for the Tesla Semi actually came from JB Straubel.

60-70 Semis have been made so far.

The design is modeled after high-speed electric trains.

Drag coefficient is at around 0.4 (current trucks are 0.8-0.9).

It has around 1,500hp, can charge 70% in 30 minutes, has similar turning radius to the Model 3&Y.

They used a lot of the same components from the previous models, like the 2 screens from Model 3&Y, the (three) carbon fiber-wrapped motors from Plaid, the drive inverter and 800-1000V architecture from Cybertruck.

This is only a day cab, but a sleeper cab version will be designed in near future.

They used stairs rather than ladder for entering through the “suicide doors”, for better esthetic, aerodynamics, and ease of use.

Bonus: speaking of latter, the ladder, here’s the Semi driving over one: (video)

Q: Can the Tesla Semi drive over a ladder?

A: yes, yes it can.

— Jaan of the EV Universe ⚡ (@TheEVuniverse)

2:20 PM • Dec 4, 2022

QUICK BITES:

Lucid rolls out a referral program in the US (link):

Buyers get $750-$1250 discount, or a special duffel bag if for Sapphire version.

Owners (the ones referring) get points redeemable for a factory tour, an HQ tour with exec launch, or a signed Lucid Air sketch.

You’d have to get five people to buy a $125k Lucid Air Grand Touring to get one of ‘em tours. Easy peasy, right?

Mercedes EQS SUV and EQA head-on crash test at 56 km/h (34.8 mph) behind-the-scenes in this 12-minute video from What’s Inside.

Kyle from Out of Spec reviews the refreshed Model 3 build quality in Europe (video).

Fisker lowers the price of the Ocean Extreme version by $7,500 in the US, and raises the entry level by $1.5k to $38,999 and Ultra trim by $3k from Nov 5th. (link)

Watch tip: Review of the Farizon SuperVan (8-minute video). Wow.

China limits graphite export (kind of)

China's Ministry of Commerce announced last week it would require foreign companies to apply for permits to receive shipments of high-purity (read: battery-grade) raw and synthetic graphite starting Dec. 1, citing national security concerns. (link)

Does this come as a retaliation of sorts against the IRA requirements and the recent EU anti-China-EV investigation? Likely.

It’s not an outright ban exactly. Nor does the government say it will or will not issue the permits easily. So this means the impact on our side of the EV World Universe is still to be seen. It sure is a gate they installed and they are the gatekeeper.

As with most battery metals, China dominates the supply and/or processing.

China is the dominant player in the global supply of both natural graphite and synthetic graphite, accounting for around 2/3 of all natural graphite production and supplies around 98% of the world's synthetic graphite anodes, according to Benchmark Minerals.

Will this create a rush to establish the supply chain beyond China? We’ll see. Just this week, Epsilon Advanced Materials (EAM), India’s top battery materials firm, unveiled plans to construct a $650M graphite anode production facility in Brunswick County, North Carolina.

“An important thing to keep in mind is that China produces far more material than it needs domestically, so they will not want to shut themselves off completely.” — Robert Burrell, analyst at Benchmark Mineral Intelligence

Watch tip: The Global Lithium Supply Chain, a nearly 2-hour-long yet entertaining overview from Jordan from The Limiting Factor — a self-made analyst on this topic, whose analysis I enjoy (video).

DEEPER LOOK: Tesla now sells its Supercharger hardware.

Yeah, you read that right. bp pulse will be the first to buy $100M worth of Tesla ultra-fast chargers and deploy them on their own independent network. Here’s what I gathered from the press release (link):

250kW chargers, rolls out as early as 2024.

With Magic Docs, so both NACS and CCS capable,

Will be installed and managed by bp pulse.

Will run on Omega, bp’s software platform. Although it’s conveniently put in the EV fleet hubs section in the press release, perhaps the public ones will run on Tesla charging OS?

Will feature Plug&Charge

First sites will be in Houston, Phoenix, Los Angeles, Chicago; and Washington D.C., for bp brands like TravelCenters of America, Thorntons, ampm; and Amoco. It’ll also launch in private EV fleet depots and in some Hertz locations.

This is a big deal. ICE car drivers will get to see fast chargers wherever they refuel at BP-owned stations, which is great for EV transition. On top of that, more fast chargers for EV owners. It's such a win-win.

"At Tesla, we’re driven to enable great charging experiences for all EV owners. Selling our fast-charging hardware is a new step for us, and one we’re looking to expand in support of our mission to accelerate the transition to sustainable energy. We appreciate bp’s partnership in this area – it’s the right step towards a more sustainable future."

Now how many Superchargers will bp pulse get for said $100M?

How much does a Supercharger cost?

Short answer: we don’t know. This will probably start coming out as more third parties do a similar deal. Until then, here’s what I know:

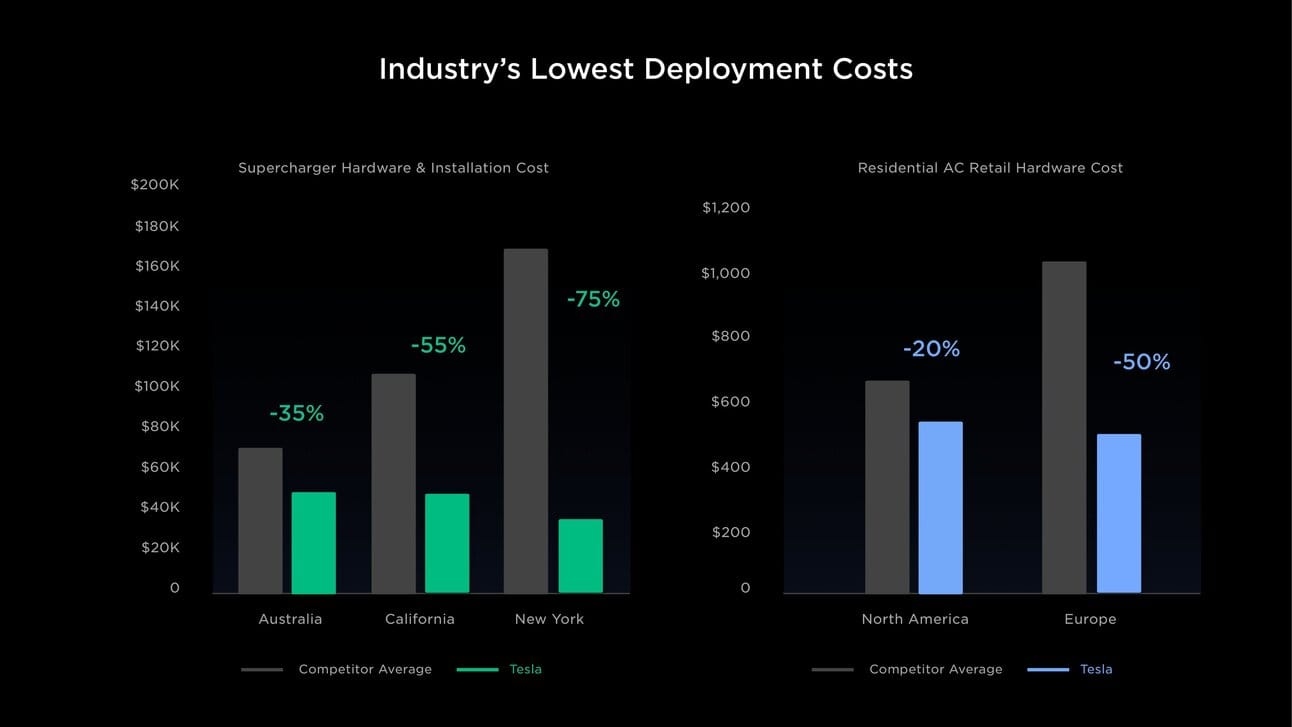

We saw from an Investor Day deck a bit back that Tesla’s Supercharger Hardware and Installation costs were between $30k and $45k in the US.

As hardware costs would be the same across US (except shipping), I think it’s safe to assume we can go with the lower number of $30k per unit. And mind you, this is with installation.

At $30k, bp Pulse would get 3,333 Supercharger units. I would assume a larger price in reality (more aligned with rest of the industry), and will report back when we get more info.

With the NEVI grants rolling out in several states, Tesla has shown superiority over other charge point operators (CPOs) with significantly lower deployment costs already. Is there a scenario here where Tesla earns a significant margin and the offer is still the most competitive offer for these CPOs?

Tesla also wins because it can either increase its utilization of existing Supercharger manufacturing lines (if there is such room) or because it can use this to expand its production capacity further. I’m very curious about the production capacity at its current stage.

What Tesla can lose is the image of the major charger reliability (even if rebranded as bp, for example), in cases where it doesn’t control the end experience anymore — even more so if it doesn’t control the software platform the run on either.

And if nothing else, bp pulse just bought a wonderful advertising campaign for just $100M. In a lot of eyes, the otherwise slightly tainted view of its charging experience went 📈.

I would imagine Tesla has a massive inbound request flow from CPOs across the world at this very moment. In case you want to share just this deeper look with others, I uploaded it as a standalone article on our site here.

Oh and what does Jaan do right after reading this news On Thursday? He makes memes.

Quick kW:

Fall 2023 Tesla Supercharger location voting is now open (link). Uljin County, South Korea; Galveston, Texas and Paks, Hungary are top three while I write this. The summer season winner was Brașov, Romania with 16,451 votes. Wow, you can bet there was quite a community effort involved! The rest of the 20 winners are listed here.

Study tip: An overview of free open source projects building charge point management systems that could change the E-Mobility world. From our friends at Electric Avenue (link).

Zero Carbon Charge will launch a charging network in South Africa, starting with 120 HPC charging stations by Q1 2025. (link) Electricity will be generated locally in each case so that the fast chargers can be supplied with renewable energy independently of the grid.

This issue went out to our 4,793 subscribers.

FEEDBACK: How did you enjoy the newsletter?you can leave me some words after clicking |

Thank you & see you soon! — Jaan

Reply